2024 JUL 11 The month June sees in "one week" 40 smaller banks in China going under: then joining the list a mid-tier bank their closes doors

28th June (MID-TIER) JIANGXI BANK of CHINA makes 41 bank close doors

without prejudice

OPINIONS

China's banking sector is facing a full-scale crisis.

Part 1:

In just one week, 40 banks disappeared, absorbed into larger institutions. Today, Jiangxi Bank of China went under, further escalating the crisis.

Jiangxi Bank of China

China's smaller banks are struggling with bad loans and exposure to the ongoing property crisis.

SCOPE OF THE PROBLEM

Some 3,800 such troubled institutions exist.

They have 55 trillion yuan ($7.5 trillion) in assets—13% of the total banking system—and have long been mismanaged, accruing vast amounts of bad loans.

Many have lent to real estate developers and local governments, gaining exposure to China’s property crisis.

In recent years, some have revealed that 40% of their books are made up of non-performing loans.

Bank of Jiujiang, a mid-tier lender, recently revealed that its profits might fall by 30% due to poorly performing loans.

This rare disclosure highlights the severity of the situation.

The authorities have been pushing for more transparency, but the true extent of the bad debt problem is still emerging.

The four state AMCs created to manage bad debts are now struggling themselves, with one needing a $6.6 billion bailout in 2021.

DISAPPEARING BANKS!

China’s main way of dealing with small, feeble banks: making them disappear. Of the 40 institutions that vanished recently, 36 were in the Liaoning province and absorbed into a new lender, called Liaoning Rural Commercial Bank, which was created as a receptacle for bad banks.

Since it was set up in September, five other institutions have been established to do similar work, with more expected.

THE ROOT CAUSE: PROPERTY SECTOR RECESSION

The root cause?

China's property sector is in a deep recession.

Overextended real-estate developers and local governments have defaulted on loans, creating a cascade of financial instability.

Property prices have plummeted, and construction projects have stalled, further straining the financial system.

HIDDEN BAD DEBTS and REGULATORY CRACKDOWN

Adding to the complexity, banks have been using asset-management companies (AMCs) to offload toxic loans, creating a facade of stability.

These AMCs buy bad loans but avoid taking on the credit risks, leading to a buildup of hidden bad debts.

The National Administration of Financial Regulation (NAFR), a new banking regulator, has been cracking down on these practices, issuing fines and increasing oversight.

WHAT IS COMING?

This regulatory vanishing act will probably pick up pace. S&P Global, a rating agency, reckons it will take a decade to complete the project.

While fewer bigger banks are easier to regulate, combining dozens of bad banks only creates bigger, badder, banks.

The fact remains that the Chinese economy is in an extended and pretend state.

Years of credit-fuelled growth has finally run its course, and the result will be lower growth for China and a negative impact on the global economy.

Slower growth of the Chinese economy will, in turn, exacerbate their banking problems too.

This will very likely end in massive liquidity injections, stimulation of the economy, and investors flocking to hard assets.

Part 2:

WHAT IS GOING ON IN CHINA?

China Remains the Biggest Risk to the Global Economy

- Stagnant Economy

- Deflationary CPI and PPI

- 300%+ Debt/GDP

- Property Sector Crisis

- CNY/USD Dropping

- Looming Demographics Crisis

A thread on six major challenges of the Chinese economy that threaten the world economy.

1/ SLUGGISH OVERALL ECONOMIC GROWTH

China's economic slowdown is a major global concern. Over the past decade, China's GDP growth has decelerated significantly, and the outlook suggests further declines.

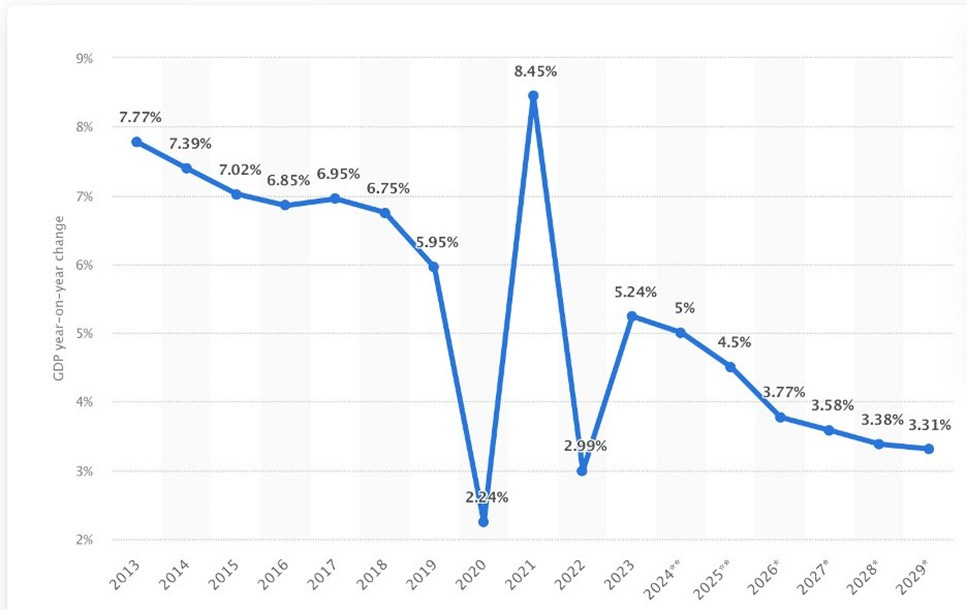

Chart 1 illustrates the growth rate of China’s real GDP from 2013 to 2023, with projections until 2029.

The trend shows a dramatic slowdown, with forecasts predicting even worse scenarios ahead.

2/ PROPERTY SECTOR CRISIS

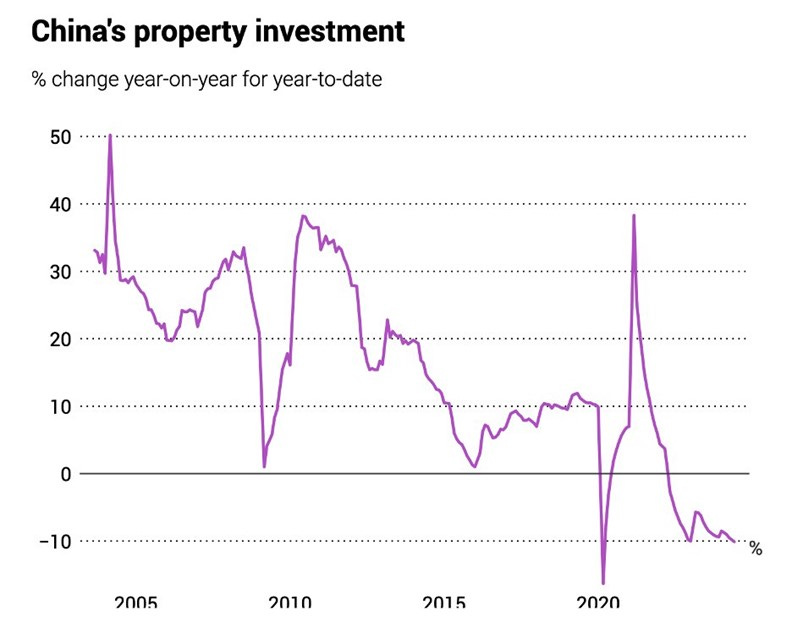

A major aspect of China’s economic troubles is the property sector crisis.

Once a cornerstone of China’s economic boom, the property market is now in turmoil. High levels of debt, unsold properties, and stalled construction projects plague the sector.

Chart 2 shows China's property investment, indicating a massive contraction currently at -10% year-over-year.

Despite government interventions, such as converting unsold homes into affordable housing, these measures fall short.

Goldman Sachs estimates that over $967 billion may be needed to stabilize the housing market, far exceeding the government's current pledges.

3/ MASSIVE DEBT PROBLEM

Normally, authorities would begin pumping liquidity to fix these problems.

However, China has stretched this solution to its limits, making it ineffective to continue.

China's debt levels are staggering, contributing to a massive non-performing debt crisis.

Chart 3 illustrates total credit to the non-financial sector as a percentage of GDP from 2000 to 2022.

This mounting debt burden affects local governments and private enterprises alike. Local government debt has surged due to falling revenues from land sales and reduced tax income.

Developers, saddled with unsustainable debts, face a wave of defaults, further destabilizing the economy.

4/ DEFLATION and CONCERNING CPI and PPI TRENDS

Adding to the economic woes are deflationary pressures. Trends in the consumer price index (CPI) and producer price index (PPI) signal a future slowdown.

Chart 4 shows China's June consumer inflation, highlighting weak demand and persistent deflation.

In June, CPI rose only 0.2% year-on-year, missing forecasts, while PPI continued to decline, reflecting weak industrial activity.

This persistent deflation underscores the structural issues in the economy and the ineffectiveness of current policy measures to boost demand.

June CPI +0.2% y/y versus +0.4% y/y Reuters poll forecast June PPI -0.8% y/y versus -1.4% y/y in May

5/ YUAN DROPS and CBOE's STRUGGLE

The yuan's decline is another symptom of China’s economic problems.

Despite interventions by the People's Bank of China (PBOC), the yuan has weakened significantly.

The PBOC’s efforts, including setting stronger midpoint rates and intervening in the market, have only had temporary effects.

The weakening yuan reflects broader economic issues, including slowing growth, high debt levels, and declining investor confidence.

The yuan is down 0.1% against the dollar this month, and 2.4% weaker this year (13% since 2022) It has been under pressure since early 2023 as domestic woes around a moribund property sector, anaemic consumption and falling yields drive capital flows out of the yuan, and foreign investors stay away from China's struggling stock market.

6/ DEMOGRAPHICS CRISIS

China is also facing a significant demographics crisis, which compounds its economic problems.

The country's population is aging rapidly, with a declining birth rate and a shrinking workforce.

In 2023, China's birth rate dropped to a historic low, and the population decreased for the first time in decades.

This demographic shift threatens long-term economic growth as the labour force contracts and the burden of supporting an aging population increases.

Without substantial reforms to address these demographic challenges, China’s economic future looks increasingly uncertain.

Summary –

China faces large and deeply entrenched economic challenges - The slowdown in overall economic growth, coupled with a severe property sector crisis, massive debt problems, deflationary trends, a weakening yuan, and a looming demographics crisis, paints a grim picture of the world’s second-largest economy.

Acknowledgements Original Sources

Credit: X (at.) Sina_21st | Editorial Part 1: “Jiangxi Bank of China goes under”

2024 JUL 09 | READ HERE

Credit: X (at.) Sina_21st | Editorial Part 2: “What is Going on in China?”

2024 JUL 12 | READ HERE

Credit: X (at.) Sina_21st | CLIP 1 (Mid-Tier) Jiangxi Bank of China goes under joining the 40 other banks in one week | 2024 JUN 28 | VIEW

Credit: Tik Tok (at.) abra.os.olhos8 | CLIP 2 (Mid-Tier) Jiangxi Bank of China goes under joining the 40 other banks in one week | 2024 JUN 28 | VIEW

Credit: X (at.) ChuckCallesto | CLIP 3 (Mid-Tier) Jiangxi Bank of China goes under joining the 40 other banks in one week | 2024 JUN 28 | VIEW

Credit: Instagram (at.) sichuankaoyu | CLIP 4 (Mid-Tier) Jiangxi Bank of China goes under joining the 40 other banks in one week | 2024 JUN 28 | VIEW

Credit: YouTuber (at.) ILLBEBACK5 | CLIP 5 (Mid-Tier) Jiangxi Bank of China goes under joining the 40 other banks in one week | 2024 JUN 28 | VIEW